As pictures of queues outside gold stores flooded social media over the past month, professional precious metals traders were getting increasingly nervous.

Gold is “an overcrowded trade that’s overextended by every technical metric,” Nicky Shiels, head of research at precious metals refiner MKS Pamp SA, wrote to clients on Oct. 6. On Monday, as prices soared to new record highs near $4,400 an ounce, Marc Loeffert, a trader at Heraeus Precious Metals, warned that the metal was “getting even more overbought.”

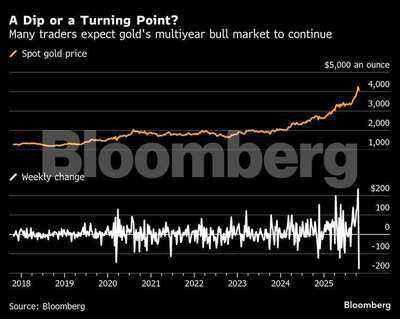

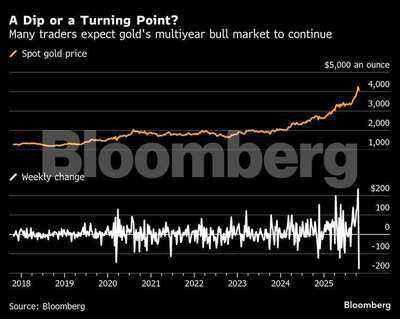

The reckoning came this week. Gold prices plunged by as much as 6.3% on Tuesday, in the biggest drop since 2013, and held losses through Friday to close at $4,113.05 an ounce. In dollar terms, its $138.77 weekly drop was among the largest ever.

Was it a turning point in gold’s multiyear bull market, or just a dip? In Bangkok’s Chinatown, the nation’s gold trading hub, Sunisa Kodkasorn, a 57-year-old textile factory worker, had no doubt about the answer.

“Gold is the best investment,” she said. “We decided to gather all our money and come today because we knew prices had dropped.”

She’s not alone: from Singapore to the US, dealers told Bloomberg they had seen a rush of interest from people looking to buy gold as prices dropped this week. Kodkasorn’s attempt to buy the dip was stymied because the size of gold bar she could afford was sold out.

And another kind of gold rush is unfolding this weekend in Kyoto, where nearly one thousand professional gold traders, brokers and refiners are descending on Japan’s ancient capital for the largest annual precious metal conference, which begins on Sunday. The professionals — notwithstanding their caution in the recent run-up — are similarly enthused by the gold market: attendance at the conference is at a record high.

“Bull markets always need a healthy correction to weed out froth and ensure the cycle has duration,” Shiels, whose initial note came a fortnight before prices peaked, said this week. “Prices should consolidate and revert to a more measured bullish trajectory.”

The gold price peaked just above $4,381 an ounce toward the end of trading on Monday. What was unusual about what came next was that it was largely confined to the precious metals markets: other major markets, from equities to Treasuries to oil, were little moved on Tuesday as bullion slid.

There was no obvious catalyst for the move: some traders pointed to profit-taking by hedge funds, others said there had been selling by Chinese banks.

But it was a reversal that gold specialists had been anticipating for some time, as the precious metal — after already smashing record highs this year — soared a further 30% in just two months.

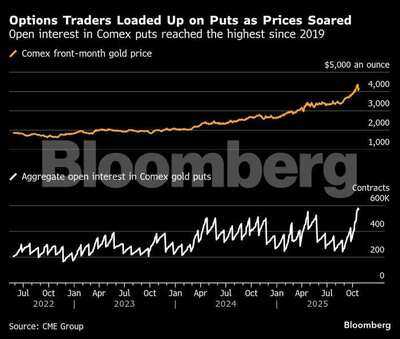

On New York’s Comex futures market, interest in bearish put options on gold rose to some of the highest levels relative to bullish call options since the global financial crisis of 2008. The manager of one commodities-focused hedge fund expressed frustration that, despite being a long-term gold bull, he had failed to fully capitalize on the rally because he had started betting on a correction too early.

Still, it remains hard to find a gold bear among precious metals analysts whose forecasts — for the most part — have been bullish but not bullish enough over the course of the last two years. When the London Bullion Market Association carried out a survey of analysts at the start of the year, almost every respondent expected prices to rise, but none thought it could trade above $3,300 during 2025.

“We expect de-risking and profit taking by investors to be met by dip buying from other segments of demand including central banks and other physical buyers, ultimately keeping reversals relatively shallow,” Gregory Shearer at JPMorgan Chase & Co. said in a note this week.

Yet the gold market’s history gives some reasons for caution. In September 2011, when gold hit a high of $1,921 before falling back, traders and analysts who gathered that month for the annual LBMA conference were almost universally bullish. As it turned out, it would take another nine years before gold reclaimed that high.

The current surge in gold has been driven by a wave of central bank buying, which accelerated dramatically after sanctions on the Russian central bank in 2022, and fears about unsustainable levels of government debt around the world.

JPMorgan’s Shearer highlighted the possibility that central banks will take a step back from the market as the major risk to his bullish forecasts, which see gold averaging more than $5,000 by the final quarter of next year.

But the most recent leg of the rally — coming after US President Donald Trump attempted to fire US Federal Reserve governor Lisa Cook — has been turbocharged by a wave of buying from ordinary “retail” investors, with gold shops running out of stock and more money piling into exchange-traded funds than ever before.

In some of the world’s main gold-buying hubs, there was little sign this week that the fall in prices had dented their enthusiasm. Some dealers reported less interest after a hectic two months, but others had record sales.

Pete Walden, deputy chief executive officer at BullionStar, a dealership in Singapore, said his company had had its busiest day ever on Tuesday. “We had a queue before opening, with many more buyers than sellers,” he said. “I think many are using it as an opportunity to buy the dip.”

In the US, Stefan Gleason of dealer Money Metals Exchange LLC, said his company had more interest from “bargain hunting” buyers than it could handle.

And in Tokyo’s swanky Ginza district, Vietnamese student Hang Viet, who is in his 20s and has lived in Japan for about a decade, arrived at a branch of Tanaka Precious Metal Group Co hoping to buy a small gold bar.

“I believe gold prices will keep rising in the long run,” he said. “I saw the current dip as an opportunity.”

Gold is “an overcrowded trade that’s overextended by every technical metric,” Nicky Shiels, head of research at precious metals refiner MKS Pamp SA, wrote to clients on Oct. 6. On Monday, as prices soared to new record highs near $4,400 an ounce, Marc Loeffert, a trader at Heraeus Precious Metals, warned that the metal was “getting even more overbought.”

The reckoning came this week. Gold prices plunged by as much as 6.3% on Tuesday, in the biggest drop since 2013, and held losses through Friday to close at $4,113.05 an ounce. In dollar terms, its $138.77 weekly drop was among the largest ever.

Was it a turning point in gold’s multiyear bull market, or just a dip? In Bangkok’s Chinatown, the nation’s gold trading hub, Sunisa Kodkasorn, a 57-year-old textile factory worker, had no doubt about the answer.

“Gold is the best investment,” she said. “We decided to gather all our money and come today because we knew prices had dropped.”

She’s not alone: from Singapore to the US, dealers told Bloomberg they had seen a rush of interest from people looking to buy gold as prices dropped this week. Kodkasorn’s attempt to buy the dip was stymied because the size of gold bar she could afford was sold out.

And another kind of gold rush is unfolding this weekend in Kyoto, where nearly one thousand professional gold traders, brokers and refiners are descending on Japan’s ancient capital for the largest annual precious metal conference, which begins on Sunday. The professionals — notwithstanding their caution in the recent run-up — are similarly enthused by the gold market: attendance at the conference is at a record high.

“Bull markets always need a healthy correction to weed out froth and ensure the cycle has duration,” Shiels, whose initial note came a fortnight before prices peaked, said this week. “Prices should consolidate and revert to a more measured bullish trajectory.”

The gold price peaked just above $4,381 an ounce toward the end of trading on Monday. What was unusual about what came next was that it was largely confined to the precious metals markets: other major markets, from equities to Treasuries to oil, were little moved on Tuesday as bullion slid.

There was no obvious catalyst for the move: some traders pointed to profit-taking by hedge funds, others said there had been selling by Chinese banks.

But it was a reversal that gold specialists had been anticipating for some time, as the precious metal — after already smashing record highs this year — soared a further 30% in just two months.

On New York’s Comex futures market, interest in bearish put options on gold rose to some of the highest levels relative to bullish call options since the global financial crisis of 2008. The manager of one commodities-focused hedge fund expressed frustration that, despite being a long-term gold bull, he had failed to fully capitalize on the rally because he had started betting on a correction too early.

Still, it remains hard to find a gold bear among precious metals analysts whose forecasts — for the most part — have been bullish but not bullish enough over the course of the last two years. When the London Bullion Market Association carried out a survey of analysts at the start of the year, almost every respondent expected prices to rise, but none thought it could trade above $3,300 during 2025.

“We expect de-risking and profit taking by investors to be met by dip buying from other segments of demand including central banks and other physical buyers, ultimately keeping reversals relatively shallow,” Gregory Shearer at JPMorgan Chase & Co. said in a note this week.

Yet the gold market’s history gives some reasons for caution. In September 2011, when gold hit a high of $1,921 before falling back, traders and analysts who gathered that month for the annual LBMA conference were almost universally bullish. As it turned out, it would take another nine years before gold reclaimed that high.

The current surge in gold has been driven by a wave of central bank buying, which accelerated dramatically after sanctions on the Russian central bank in 2022, and fears about unsustainable levels of government debt around the world.

JPMorgan’s Shearer highlighted the possibility that central banks will take a step back from the market as the major risk to his bullish forecasts, which see gold averaging more than $5,000 by the final quarter of next year.

But the most recent leg of the rally — coming after US President Donald Trump attempted to fire US Federal Reserve governor Lisa Cook — has been turbocharged by a wave of buying from ordinary “retail” investors, with gold shops running out of stock and more money piling into exchange-traded funds than ever before.

In some of the world’s main gold-buying hubs, there was little sign this week that the fall in prices had dented their enthusiasm. Some dealers reported less interest after a hectic two months, but others had record sales.

Pete Walden, deputy chief executive officer at BullionStar, a dealership in Singapore, said his company had had its busiest day ever on Tuesday. “We had a queue before opening, with many more buyers than sellers,” he said. “I think many are using it as an opportunity to buy the dip.”

In the US, Stefan Gleason of dealer Money Metals Exchange LLC, said his company had more interest from “bargain hunting” buyers than it could handle.

And in Tokyo’s swanky Ginza district, Vietnamese student Hang Viet, who is in his 20s and has lived in Japan for about a decade, arrived at a branch of Tanaka Precious Metal Group Co hoping to buy a small gold bar.

“I believe gold prices will keep rising in the long run,” he said. “I saw the current dip as an opportunity.”

You may also like

'I went on The Wheel and won £110K - I have a special plan for the winnings'

Tom Aspinall UFC return fight called off after champion poked in the eyes

Liverpool player ratings vs Brentford as Szoboszlai let down by his team-mates in loss

Karnataka Dy CM defends tunnel project, calls Tejasvi Surya "empty vessel"; challenges Kumaraswamy for open debate

'I'm a dog expert and this is how to stop your dog barking at the doorbell'